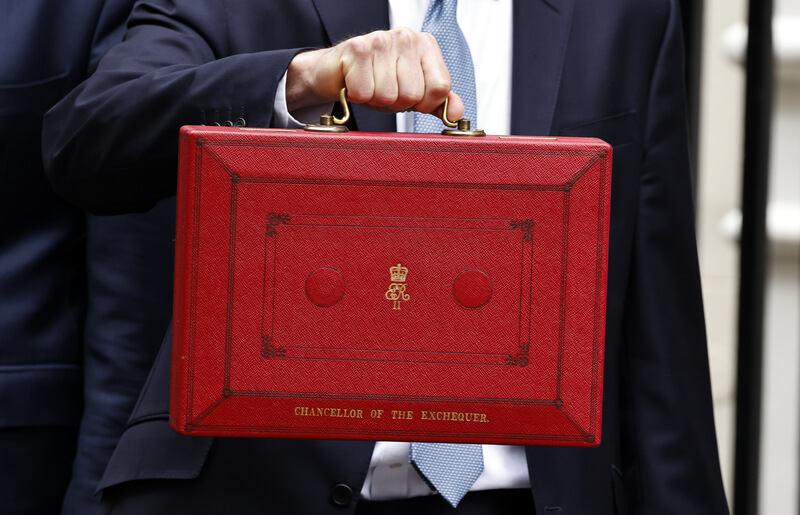

AUTUMN BUDGET 2024

Our summary of the main points

Rachel Reeves presented the Autumn Budget on 30 October 2024, and we’ve sifted through the measures to pick out these key messages:

- There’s no change to the amount that people can take tax-free from their pension – the lump sum allowance

- Pension death benefits may be subject to inheritance tax from April 2027

- Employers’ National Insurance contributions are increasing to 15% from April 2025

- Capital gains tax rates equalised against the property rates

Here’s our summary of the wider points from the budget.

Pensions

Lump sum allowance

Despite speculation that the lump sum allowance – and therefore the amount that could be taken tax-free – could be significantly reduced, it’s a welcome relief to see that there are no changes to the lump sum allowance or the lump sum and death benefit allowance.

State Pension

The State Pension is set to rise by 4.1% from April 2025, as the triple lock is retained. The full new State Pension will increase from £221.20 per week to £230.25.

For those who reached State Pension age before 6 April 2016, the basic State Pension will increase from £169.50 per week to £176.45.

Pension death benefits

In recent years, pension schemes have been increasingly used as a tax planning tool to transfer wealth without an inheritance tax charge, rather than for their intended purpose of funding retirement. The Chancellor announced a consultation to bring unused pensions and death benefits into scope of inheritance tax (IHT) from April 2027.

The consultation is looking to remove:

- The incentive to use pensions as a tax planning vehicle for wealth transfer after death

- The distinction between how discretionary and non-discretionary death benefits will be taxed

Currently, unclaimed pension benefits payable at the trustee’s discretion are not taken into account when determining the value of an individual’s estate.

From 2027, unclaimed pension benefits will be included in the value of an estate, and IHT will need to be deducted if the deceased’s estate exceeds their IHT threshold.

Important areas to review include the total assets that will be valued for IHT purposes, and whether for instance tax-free cash should be maximised during one’s lifetime. Wider planning may be needed to manage and gift other assets, and for the application of spousal exemptions.

National insurance

The thresholds and rates of employee national insurance contributions are not increasing. The freeze on the threshold isn’t planned to be extended beyond the 2028/29 tax year. However, the Chancellor has raised national insurance contributions for employers by 1.2%, taking the rate to 15% from April 2025.

The salary threshold at which companies pay the tax has also been lowered, from £9,100 a year to £5,000 a year.

While this means employers’ national insurance costs will increase, this change increases the value of salary sacrifice schemes for employers. Such schemes can potentially offset some of those increased costs if employees agree to reduce their salary for increased pension contributions.

Pension transfers overseas

With the aim of reducing opportunities for UK residents to receive double tax-free allowances, from 30 October 2024, the government are removing the tax exemption that applies to the Overseas Transfer Charge for transfers to Qualifying Recognised Overseas Pension Schemes (QROPS) in the European Economic Area or Gibraltar.

Other existing exclusions to the overseas transfer charge remain valid, such as transfers where the member is resident in the same country as the QROPS.

The government will bring in line the conditions of Overseas Pension Schemes (OPS) and Recognised Overseas Pension Schemes (ROPS) established in the EEA, with OPS and ROPS established in the rest of the world from 6 April 2025.

Capital Gains Tax

The following increases to the main capital gains tax (CGT) rates were announced, effective immediately:

- Lower CGT rate increases from 10% to 18%

- Higher CGT rate increases from 20% to 24%

However, the Chancellor highlighted that these new rates remain internationally competitive, lower than comparable EU countries.

There will also be a two-stage phased increase to the CGT rates for Business Asset Disposal Relief and Investors’ Relief, rising to 14% from 6 April 2025, and then to 18% from 6 April 2026.

In addition, the lifetime limit for Investors’ Relief will be reduced to £1 million for all qualifying disposals made on, or after, 30 October 2024.

Conclusion

As always, individual circumstances will differ, and if you would like to review and discuss how these changes might affect you and your financial plans, please do get in touch:

Andrew Smith andrew@michaelforward.co.uk 01908 504083

Heidi Spencer heidi@michaelforward.co.uk 07851 836 362

Michael Forward michael@michaelforward.co.uk 01604 635 435