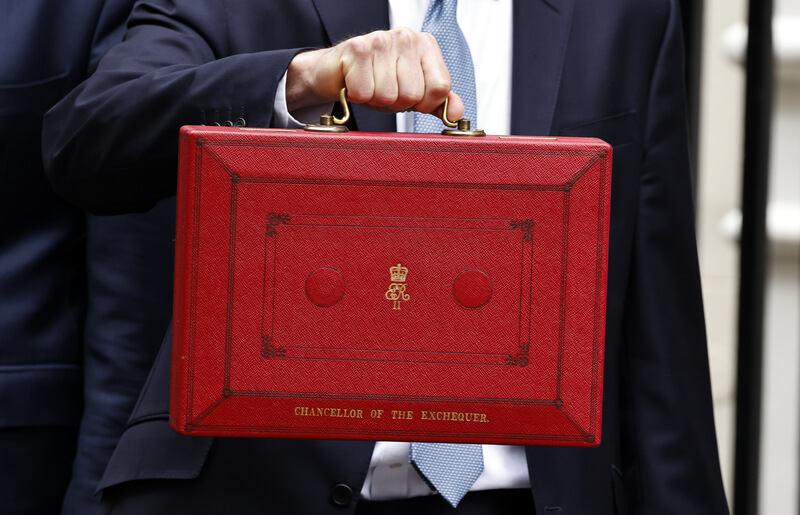

AUTUMN BUDGET 2024

Our summary of the main points Rachel Reeves presented the Autumn Budget on 30 October 2024, and we’ve sifted through the measures to pick out these key messages: Here’s our summary of the wider points from the budget. Pensions Lump sum allowance Despite speculation that the lump sum allowance – and therefore the amount that […]

Read More